Fiscally Responsible Outcomes and Economic Growth Strategy

2023

Capital Investments

Manitoba’s investments in schools, health care, highways, housing, municipal infrastructure and other capital assets provide multiple benefits to society. These strategic investments provide an immediate economic stimulus, generating jobs and boosting the incomes of Manitobans.

These investments also provide long-term social benefits of making communities more resilient, Manitoba more competitive in the global market, healing health care, protecting the environment and parks, and advancing productivity and wellness.

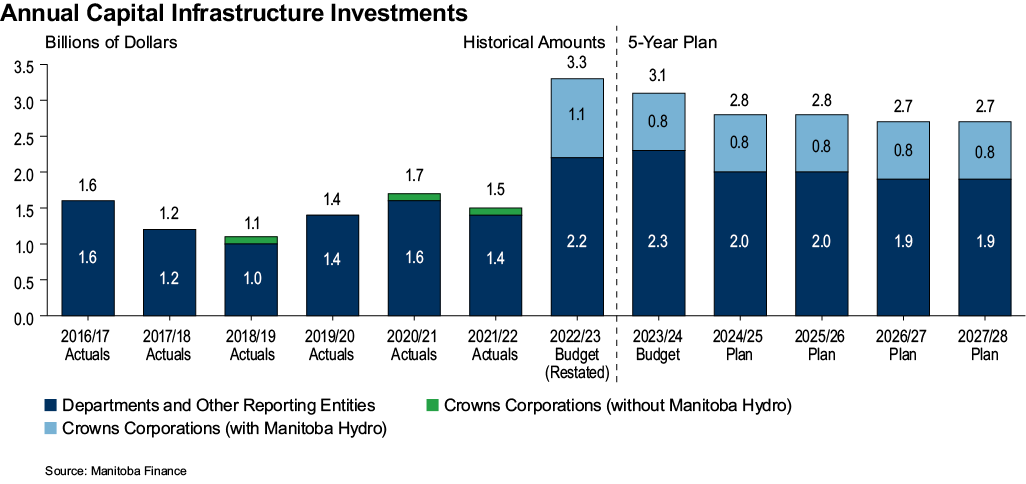

This year’s multi-year capital investment plan follows best practises in Canada and has been expanded to a five-year plan which is able to provide a more strategic outlook of future year priorities and commitments.

As witnessed in the past two years, capital delivery has been made more difficult by unprecedented inflation and supply chain issues due to a pandemic, and geo-political instability; this is in addition to weather and climate challenges.

This change to a long-term plan will provide targets to ensure government stays on track in uncertain times on needed strategic infrastructure commitments and provides transparency to Manitobans. This will also help our construction industry, by ensuring they are better able to plan for labour or equipment needs in upcoming years.

The five-year plan is ambitious, with a total investment of over $14-billion in strategic infrastructure planned over five years, and more than $3-billion in strategic infrastructure spending planned for 2023/24.

Five Year Capital Plan, 2023/24 - 2027/28

Building from the three-year capital plan in Budget 2022, the 2023/24 budget expands the multi-year capital plan to five years. The overview of the five-year capital plan is included on the table and graphs below and a listing of major projects in planning or delivery stages in 2023/24 is attached in Appendix: Manitoba Capital Highlights on page 73.

Work is well underway to develop and maintain a government-wide inventory of the condition of assets that will facilitate better prioritization of capital investments and proactive asset management.

This plan provides funding for new and ongoing projects to address essential infrastructure needs, stimulate economic recovery, and ensure Manitoba’s continued success.

Capital Infrastructure Investment Plan

|

Capital Infrastructure Investments |

|||||||

|

(Millions of Dollars) |

2022 Budget (Restated) |

2023 Budget |

2024

|

2025

|

2026

|

2027

|

5 Year

|

|

BUILDINGS, EQUIPMENT AND TECHNOLOGY |

|||||||

|

Health |

294 |

291 |

295 |

298 |

297 |

293 |

1,474 |

|

K-12 and Advanced Education |

383 |

387 |

368 |

350 |

310 |

252 |

1,667 |

|

Housing |

67 |

67 |

67 |

67 |

67 |

67 |

335 |

|

Other Departments |

135 |

332 |

86 |

84 |

85 |

82 |

669 |

|

Information Technology |

81 |

84 |

92 |

70 |

66 |

60 |

372 |

|

960 |

1,161 |

908 |

869 |

825 |

754 |

4,517 |

|

|

ROADS, HIGHWAYS, BRIDGES AND FLOOD PROTECTION |

|||||||

|

Highways & Airport Runway Capital |

474 |

563 |

506 |

506 |

506 |

506 |

2,587 |

|

Manitoba Restart Capital Program |

111 |

- |

- |

- |

- |

- |

- |

|

Lake Manitoba Outlet Channel |

107 |

101 |

101 |

101 |

101 |

101 |

505 |

|

Water Related Infrastructure |

32 |

32 |

33 |

33 |

33 |

33 |

164 |

|

Transportation Equipment and Aircraft |

7 |

7 |

7 |

7 |

7 |

7 |

35 |

|

731 |

703 |

647 |

647 |

647 |

647 |

3,291 |

|

|

OTHER REPORTING ENTITIES |

|||||||

|

Efficiency Manitoba |

66 |

66 |

66 |

66 |

66 |

66 |

330 |

|

Other |

53 |

66 |

65 |

65 |

66 |

66 |

328 |

|

119 |

132 |

131 |

131 |

133 |

133 |

658 |

|

|

CAPITAL GRANTS |

|||||||

|

Municipal Grants |

292 |

160 |

160 |

160 |

160 |

160 |

800 |

|

Northern Affairs Communities |

4 |

4 |

4 |

4 |

4 |

4 |

20 |

|

296 |

164 |

164 |

164 |

164 |

164 |

820 |

|

|

MAINTENANCE AND PRESERVATION |

|||||||

|

Highways Infrastructure |

124 |

137 |

137 |

137 |

137 |

137 |

685 |

|

Water Related Infrastructure |

13 |

14 |

14 |

14 |

14 |

14 |

70 |

|

137 |

151 |

151 |

151 |

151 |

151 |

755 |

|

|

CROWN CORPORATIONS |

|||||||

|

Manitoba Liquor and Lotteries Corporation |

71 |

91 |

73 |

52 |

49 |

49 |

314 |

|

Manitoba Public Insurance Corporation |

87 |

76 |

50 |

56 |

11 |

12 |

205 |

|

Manitoba Hydro |

907 |

654 |

651 |

692 |

699 |

775 |

3,471 |

|

1,065 |

821 |

774 |

800 |

758 |

835 |

3,990 |

|

|

TOTAL STRATEGIC INFRASTRUCTURE INVESTMENTS |

3,308 |

3,132 |

2,775 |

2,762 |

2,678 |

2,684 |

14,031 |

Manitoba Permanent Resident Landings

Handling Uncertainty and Capital Plan Modernization

As the province develops long-term capital plans, it is important to recognize that capital projects take years to complete, and there can be unforeseen challenges to some projects that result in delays while other projects experience hurdles due to inflation.

Planned appropriation legislation will allow for capital expenditure authority that would otherwise lapse to be redirected towards priority areas such as school construction, the construction of health facilities in our communities, highway and road construction, and building social housing.

Capital Infrastructure Investments in the Five-Year Plan

The following investments are included in the five-year capital plan by government departments.

Manitoba Consumer Protection and Government Services

Capital infrastructure delivery services to government departments have been centralized in Manitoba Consumer Protection and Government Services. These services include information technology, capital project planning and delivery, and asset management for government-owned buildings.

The department provides property services for owned capital assets, provides project management and real estate services to government, and oversees real estate and property asset disposal. Assets administered by the department include the Legislative Building, the Manitoba Museum and Centennial Concert Hall, correctional institutes, courts and government office spaces.

This includes the Enterprise Resource Planning Modernization project that will upgrade critical business functions and support business transformation programs like Procurement Modernization and Finance and Administration Services Consolidation. It will streamline, digitize and standardize government operations to align with industry best practices and provide a platform to support the introduction of common business processes across the enterprise.

The Legislative Building Centennial Restoration and Preservation Act, through its statutory appropriation, continues to commit $10-million annually for upkeep and restoration. Projects of significance include the restoration of the 106-year-old service tunnel spanning Broadway and heritage exterior restoration on the east fašade of the Legislature.

Manitoba Education and Early Childhood Learning

Over the last five years, $984-million has been invested in education capital spending, with an additional $1.297-billion planned over the next five years.

With 14 schools under construction or completed and another nine planned, the Manitoba government is on track to exceed the commitment to build 20 new schools by 2028. New schools going into design and construction in 2023/24 include K-8 schools in Sage Creek (Division scolaire franco-manitobaine and Louis Riel School Division), Seven Oaks School Division (Precinct F), Morden and Steinbach as well as a Grade 9 to 12 high school in Winnipeg.

Each new school includes the development of early learning and child-care spaces to increase availability of services for Manitoba families.

Investments have and continue to be made in existing school buildings to maintain a safe, healthy and accessible environment for students throughout the province.

Manitoba Natural Resources and Northern Development

Capital investments in natural resources and northern development are a key component in the delivery of many public-facing and conservation-focused programs including the management and operation of provincial parks and trails, natural resource stewardship, water stewardship and forest fire suppression activities across the province.

Highlights of the plan include expansions to yurt villages and other `glamping’ developments, campground infrastructure, electrification projects, significant trail improvement projects, and the redevelopment of the North Whiteshell Museum at Nutimik Lake.

Manitoba Families

Over the last five years, $205-million has been invested in housing with an additional $335-million planned over the next five years. Through the Manitoba Housing Renewal Corporation, the government supports the development of safe and affordable housing, particularly for those of low and moderate income or those with specialized needs. Significant investments have been made to repair and restore existing social housing units and address the repair backlog.

Plans for new buildings are being prioritized with the first new building to be planned and designed in 2023/24. New buildings will allow flexibility to move tenants out of existing buildings requiring significant retrofits and will later provide additional units to the housing portfolio.

Manitoba Health

Manitoba is making a historic capital investment in building, expanding and renovating health care facilities across the province in support of Manitoba’s Clinical and Preventive Services Plan. The plan, led by clinicians, improves access to care for all Manitobans and identifies planned investments in health infrastructure as being pivotal to efforts to support better care sooner and as close to home as possible.

In addition to the projects under the Clinical and Preventive Services Plan, Manitoba’s continued commitment to the expansion and redevelopment of rural and northern health care facilities is under way, including upgrading and replacement of building infrastructure and medical equipment such as diagnostic equipment, roof replacements, heating/cooling and electrical services, and upgrading and installation of fire protection systems in personal care homes.

The five-year capital plan includes project investments in new hospitals in Neepawa and Portage la Prairie, expansions at the Selkirk Regional Health Centre, Boundary Trails Health Centre and Bethesda Regional Health Centre, along with redevelopment and expansion projects at several sites including Virden, Souris, Killarney, Shoal Lake, Arborg, Beausejour and the emergency department at St. Boniface Hospital in Winnipeg.

Manitoba Municipal Relations

To support environmental, economic and social needs in communities and mitigate against adverse market conditions, Manitoba continues to support and facilitate innovative infrastructure funding solutions by working with provincial departments and external bodies, such as municipalities or the broader private sector, to make large, strategic and complex projects possible for Manitobans.

Drawing on best practices from other jurisdictions, Manitoba continues to develop strategic partnerships with the Canada Infrastructure Bank and others, exploring the merits of alternative delivery models or working with clients to leverage national, merit-based grants in support of both federal and provincial infrastructure initiatives.

Investments in infrastructure in Manitoba municipalities include Manitoba’s investments under the partnership with the Federal Government in the Investing in Canada Infrastructure Program (ICIP). More than $1.17-billion in federal funding will be available to support Manitoba’s infrastructure needs.

Manitoba has advanced 136 projects to Canada under the program, worth $3.2-billion in total project costs. Almost all provincial funding available under ICIP has been applied for, and 99 projects have been approved and jointly announced to date, with more federal approvals pending.

These projects will benefit Manitoba’s post-pandemic economic recovery by supporting job creation and economic growth while promoting sustainability, improving public spaces, modernizing water and waste-water treatment systems, mitigating impacts of climate-related events and enhancing public transit.

The Manitoba Water Services Board has significantly expanded the amount of construction undertaken to replace, upgrade or expand municipal potable water and sewer infrastructure throughout Manitoba.

In 2022, the board tendered and awarded 40 construction projects with a total construction cost of approximately $130ámillion, which includes a new water treatment plant and groundwater supply for the Town of Beausejour, a wastewater treatment lagoon expansion in Rosenort in the Rural Municipality of Morris, water and sewer main renewals in the Town of Snow Lake and phase two of the Town of Neepawa’s wastewater treatment facility upgrades.

Manitoba Transportation and Infrastructure

The Manitoba government has a vision to expand Manitoba as a transportation hub, improving trade access to markets and supporting investment in trade-based industry.áIn support of this vision, Manitoba is establishing a senior level advisory council. Long-term strategic initiatives are in place to build the foundation for Manitoba’s economic growth, including the Winnipeg One Million Perimeter Freeway Initiative and the Trade and Commerce Strategy.

The five-year plan will see more than $2.5-billion invested, and annual minimum commitments of $500-million in highway capital with some of the highlights including:

- investing in an access-controlled Perimeter Highway freeway system with major enhancements such as the interchanges at St. Mary’s Road (PR 200) and McGillivray Boulevard (PTH 3) to ensure the movement of goods along key international trade corridors;

- investing in national trade corridors, initially focusing on the twinning of PTH 1 from Falcon Lake to the Ontario border;

- investing in key trade and commerce routes to efficiently move goods within and across borders, including the reconstruction on PTH 12, rehabilitation on PTH 5 and a structure replacement on PTH 5 at Assiniboine River (Spruce Woods);

- supporting improved connectivity construction, with work commencing on the twinning of PTH 6 north of Winnipeg and PTH 3 southwest of Winnipeg;

- developing additional planned resiliency projects including the structure rehabilitation at Rivers Dam, structure replacements at Deloraine, Falcon Lake and Wanipigow Dams and a structure replacement at PR 305 at Red River (Ste. Agathe).

Crown Corporations - Manitoba Hydro

A significant project included in the five-year capital plan is the Pointe du Bois Renewable Energy Project, which will increase capacity and the annual amount of clean, low-cost, renewable energy generated at the Pointe du Bois Generating Station.

Crown Corporations - Manitoba Liquor and Lotteries

Crown Corporations - Manitoba Public Insurance

Manitoba Public Insurance continues to invest in technology to modernize and transform the corporation’s services, placing customers at the forefront by enabling expanded online service options for Manitobans.

Appendix: Manitoba Capital Highlights

Major Capital Projects

|

Manitoba Education and Early Childhood Learning |

||

|

School/Location |

School Division |

Activity |

|

Morden |

Western School Division |

New K-8 School and Child Care |

|

Precinct F |

Seven Oaks School Division |

New K-8 School and Child Care |

|

Sage Creek / Bonavista |

Louis Riel School Division |

New K-8 School (French Immersion) |

|

Sage Creek |

Division scolaire franco-manitobaine |

New K-8 School (Franšais) |

|

Bison Run School in Waverley West |

Pembina Trails School Division |

New K-8 School |

|

West Steinbach |

Hanover School Division |

New K-4 School and Child Care |

|

King Edward High School |

Winnipeg School Division |

New 9-12 High School and Child Care |

|

Pembina Trails Collegiate in Waverley West |

Pembina Trails School Division |

New 9-12 School |

|

Ecole Regent Park |

River East Transcona School Division |

Gym addition, Renovation and Child Care |

|

╔cole Saint Joachim School |

Division Scolaire Franco-Manitobain |

Classroom Addition and Renovation |

|

Ecole St. Malo |

Red River Valley School Division |

Classroom Addition |

|

Gordon Bell High School |

Winnipeg School Division |

Wall and roof replacement, mechanical upgrades |

|

Green Valley School |

Hanover School Division |

Gym, Classroom Addition and Renovation |

|

Marion School |

Louis Riel School Division |

Gym, Classroom Addition and Child Care |

|

RD Parker Collegiate |

Mystery Lake School Division |

Exterior repairs, Roof Replacement and Band Room Addition |

|

Sir William Osler School |

Winnipeg School Division |

Gym, Classrooms Addition, Renovations and Child Care |

|

Manitoba Advanced Education and Training |

||

|

School |

Location |

Activity |

|

Red River College |

Winnipeg |

Nursing Lab |

|

Manitoba Healthá- Health Facility Investments |

||

|

Health Facility/Personal Care Home |

Service Delivery Organization |

Activity |

|

Boundary Trails Hospital |

Southern Health-SantÚ Sud |

Energy Centre Expansion |

|

Boyne Lodge Personal Care Home |

Southern Health-SantÚ Sud |

Redevelopment of 110 Beds |

|

Brandon Regional Health Centre |

Prairie Mountain Health |

Emergency Department Redevelopment |

|

Churchill Health Centre Nursing Station |

Winnipeg Regional Health Authority |

Emergency Response Stations Upgrades |

|

Grace Hospital Intensive Care Unit |

Winnipeg Regional Health Authority |

Renovation and Expansion |

|

Health Sciences Centre |

Shared Health |

Adult Emergency Department, Emergency Psychiatry and Addictions Area |

|

Health Sciences Centre |

Shared Health |

Adult Inpatient Unit Refresh |

|

Saint Boniface General Hospital |

Winnipeg Regional Health Authority |

Emergency Department Redevelopment |

|

The Pas Primary Care Clinic |

Northern Regional Health Authority |

New Primary Care Clinic |

|

Thompson General Hospital |

Northern Regional Health Authority |

Emergency Department Redevelopment |

|

Victoria Hospital |

Winnipeg Regional Health Authority |

Building Envelope |

|

Parkview Place Personal Care Home |

Winnipeg Regional Health Authority |

Replacement Beds for Convalescent Home |

|

CancerCare Manitoba |

CancerCare Manitoba |

Immediate Needs and Stabilization and Strengthening Services to 2025 |

|

Health Sciences Centre |

Shared Health |

Surgical Centre of Excellence |

|

MANITOBA HEALTH - HEALTH SYSTEM CAPITAL INVESTMENTS |

|

|

Activity |

Scope/Location |

|

Clinical Preventative Services Plan |

Multiple Health Facilities |

|

Cybersecurity Improvements |

Province-Wide |

|

Emergency Response Services Upgrades |

Multiple Health Facilities |

|

Health-care System Transformation Projects |

Province-Wide |

|

Fire Safety Improvements |

Province-Wide |

|

Personal Care Home New Construction |

Various Locations |

|

Provincial Pharmaceutical Distribution and Sterile Compounding Improvements |

Province-Wide |

|

Primary Care Enrolment and Clinical Info Sharing Program |

Province-Wide |

|

Provincial Electronic Patient Record - Brandon |

Information Technology |

|

Provincial Electronic Patient Record Clinical Documentation Ambulatory |

Information Technology |

|

Provincial Information Management and Analytics Solution |

Province-Wide |

|

Service Delivery Organization Infrastructure Transition Project |

Province-Wide |

|

Wi-Fi Expansion |

Province-Wide |

|

Manitoba Families |

||

|

Project |

Location |

Activity |

|

Burrows and Keewatin-FP01 (Gilbert Park) |

Winnipeg |

Site Improvement and Sanitary Waste and Storm Water Piping Upgrades |

|

Manitoba Consumer Protection and Government Services |

||

|

Facility |

Location |

Activity |

|

219 Memorial and Legislative Assembly |

Winnipeg |

Central Power House Tunnel Refurbishment, Roadwork and Repair |

|

Centennial Concert Hall |

Winnipeg |

Cladding Upgrade |

|

Dauphin Courthouse |

Dauphin |

Renovation and Expansion |

|

Legislative Building |

Winnipeg |

Heritage Preservation and Exterior Stone Restoration |

|

Thompson Provincial Office Building |

Thompson |

Expansion of Court Spaces |

|

Cyber Security Risk Reduction Program |

Province-Wide |

Technology |

|

Manitoba Technology Risk Reduction Program |

Province-Wide |

Technology |

|

Enterprise Resource Planning Modernization Program |

Province-Wide |

Technology |

|

Courts Modernization |

Various |

Technology |

|

Customer Relationship Management - Case Management and Workflow Solutions |

Province-Wide |

Technology |

|

Computer Assisted Mass Appraisal System |

Province-Wide |

Technology |

|

Manitoba Transportation and Infrastructure - Airports and Water Infrastructure |

||

|

Project |

Location |

Activity |

|

Lake Manitoba and Lake St. Martin Outlet Channels |

Lake Manitoba and Lake St. Martin |

Flood Protection |

|

Boundary Creek Drain: 2,3,4,5,6-18-3E |

Boundary Creek Manitoba |

Drain Reconstruction |

|

Deloraine Dam: 30-02-22W |

Deloraine |

Structure Replacement |

|

Emerson - West Lynne Pump Station* |

Emerson-West Lynne Dike |

Pump Station Rehabilitation & Replacement |

|

Portage Diversion Outlet |

Lake Manitoba, R.M. of Portage La Prairie |

Structure Rehabilitation (Flood Recovery) |

|

Quesnel Lake Dam |

Quesnel Lake |

Structure Rehabilitation (Flood Recovery) |

|

Rivers Dam: SW 19-12-20W Mitigation |

Lake Wahtopanah, Near Rivers Manitoba |

Spillway, Dam & Control Structure Rehabilitation (Flood Mitigation & Flood Recovery) |

|

St. Adolphe Dike Pump Station Rehabilitation* |

St. Adolphe |

Pump Station Rehabilitation |

|

Gods Lake Narrows Airport* |

Gods Lake Narrows |

Runway Repairs/Improvements |

|

Oxford House Airport |

Oxford House |

Runway Rehabilitation |

|

*Cost-shared with other levels of government, Airports Capital Assistance Program (ACAP), Investing in Canada Infrastructure Program, Green Infrastructure Stream (ICIP-GIS) and Adaptation, Resilience and Disaster Mitigation program (ARDM) |

||

|

Manitoba Transportation and Infrastructure - Highway Construction and Repair |

||

|

Highway |

Location |

Activity |

|

HWY 1 |

0.8km West of PR 334 to PR 334 |

Concrete Reconstruction* |

|

HWY 1 |

Vicinity of PTH 12 |

Bituminous Reconstruction |

|

HWY 1 |

Brokenhead River to PTH 11 (W/B) |

Bituminous Reconstruction * |

|

HWY 1 |

PTH 11 to PR 308 (W/B) |

Bituminous Reconstruction* |

|

HWY 1 |

PR 248 to East Junction of PTH 26 (E/B) |

Bituminous Reconstruction* |

|

HWY 1 |

At Symington Yard Overpass (East of Winnipeg) |

Structure Replacement |

|

HWY 1 |

At Assiniboine River: 0.8km West of East Junction PTH 26 (E/B) |

Structure Replacement |

|

HWY 1 |

West Junction PTH 26 (Portage la Prairie) to 1km West of PTH 13 (E/B) |

Bituminous Reconstruction |

|

HWY 1 |

At PTH 1A West Junction (Portage Diversion to Can-Oat Road) |

Bituminous Reconstruction |

|

*Cost-shared with the Federal Government through the Provincial Territorial Infrastructure Component (PTIC) part of the Nation Rebuilding Program (NRP). |

||

|

HWY 1 |

3.4km West of PTH 83 (Hargrave) to PR 257 (E/B) |

Bituminous Rehabilitation * |

|

HWY 1 |

6km West of PTH 21 E Junction PR 250 (E/B) |

Bituminous Rehabilitation * |

|

HWY 1 |

5km West of PR 301 to Ontario Boundary |

Bituminous Reconstruction (Twinning) |

|

HWY 001A |

Portage la Prairie Bypass: 7.6km East of PR 305 (West of Portage la Prairie) |

Structure Replacement |

|

HWY 001A |

At Interchange: 1.3km West of PTH 26

|

Structure Replacement |

|

HWY 2 |

PR 240 to PTH 13 |

Bituminous Rehabilitation * |

|

HWY 3 |

PTH 31 to 1.9km West of PR 432 |

Bituminous Rehabilitation * |

|

HWY 3 |

PTH 23 to 0.7km South of PTH 13 |

Bituminous Rehabilitation * |

|

HWY 3 |

0.3km East of PTH 13 to 0.2km West of PR 336 |

Bituminous Reconstruction |

|

HWY 3 |

0.2km West of PR 336 to PR 305 (Morris River) |

Bituminous Reconstruction |

|

HWY 3 |

1.6km East of PTH 100 (Wyper Road) to 6.7km East of PTH 100 (Winnipeg City Limits) |

Bituminous Reconstruction (Twinning) |

|

HWY 3 |

North Junction PTH 3A to North Junction PTH 34 |

Bituminous Reconstruction |

|

HWY 3 |

At Souris River: 0.7km East of North Junction of PTH 83 (Vicinity of Melita) |

Structure Replacement (Flood Mitigation) |

|

HWY 3 |

Saskatchewan Boundary to South Junction

|

Bituminous Rehabilitation |

|

HWY 5 |

PTH 23 to PTH 2 |

Bituminous Rehabilitation |

|

HWY 5 |

15.0km North of PTH 2 to PTH 1 |

Bituminous Rehabilitation |

|

HWY 5 |

At Assiniboine River: 11.1km North of PTH 2 (AtáSpruce Woods) |

Structure Replacement |

|

HWY 5 |

At Lake of the Prairies to 12.6km West of PTH 83 (West of Roblin) |

Structure Rehabilitation |

|

HWY 005A |

In Dauphin: Triangle Road to Whitmore Ave |

Bituminous Reconstruction |

|

HWY 6 |

PTH 101 to Grosse Isle |

Bituminous Reconstruction (Twinning & Passing Lanes) * |

|

HWY 6 |

0.4km North of PR 419 to South Junction PTH 68 (Lundar to Eriksdale) |

Bituminous Rehabilitation * |

|

HWY 6 |

0.4km North of North Junction PR 237 to 0.6km South of PR 239 (Moosehorn to North of Grahamdale) |

Bituminous Rehabilitation * |

|

*Cost-shared with the Federal Government through the Provincial Territorial Infrastructure Component (PTIC) part of the Nation Rebuilding Program (NRP). |

||

|

HWY 9 |

0.1km North of PTH 101 to 1.7km South of

|

Bituminous Rehabilitation |

|

HWY 10 |

1.2km North of North Junction PTH 16 to 11.6km North of North Junction PTH 16 |

Bituminous Reconstruction * |

|

HWY 10 |

In Brandon: Daly Overpass

|

Structure Replacement * |

|

HWY 10 |

At Duck River North: 0.5km North of PTH 20

|

Structure Replacement |

|

HWY 12 |

1.8km North of PTH 52 (Park Road) to Seine River Diversion (N/B & S/B) |

Bituminous Rehabilitation |

|

HWY 15 |

PR 206 to Brokenhead River |

Bituminous Reconstruction |

|

HWY 16 |

2km West of PR 242 to 1.8km East of PR 242 |

Bituminous Reconstruction * |

|

HWY 16 |

PR 472 - West Junction PR 264

|

Bituminous Reconstruction |

|

HWY 18 |

North Limit of Killarney to PTH 23 |

Bituminous Rehabilitation |

|

HWY 21 |

North Junction of PR 355 to 1st Ave

|

Bituminous Reconstruction |

|

HWY 21 |

US Border to 3km South of PTH 3 |

Bituminous Rehabilitation |

|

HWY 23 |

PR 336 to PR 422 |

Bituminous Reconstruction |

|

HWY 23 |

West Junction PTH 18 to PTH 5 |

Bituminous Rehabilitation |

|

HWY 23 |

PTH 5 to PTH 34 |

Bituminous Rehabilitation |

|

HWY 23 |

South Jct PTH 10 West Jct PTH 18 |

Bituminous Rehabilitation |

|

HWY 34 |

PTH 1-PTH 16 |

Bituminous Reconstruction |

|

HWY 34 |

At Assiniboine River: 12.2km North of PTH 2 (North of Holland) |

Structure Replacement |

|

HWY 39 |

PR 627 (Reed Lake) to PR 392 |

Bituminous Rehabilitation |

|

HWY 59 |

US Border to PR 403 |

Bituminous Reconstruction |

|

HWY 59 |

At Floodway: 4.5km North of PTH 101 (Vicinity of Birds Hill) |

Structure Replacement |

|

HWY 59 |

At Brokenhead River: 3.8km South of PR 319 (Vicinity of Scanterbury) |

Structure Replacement |

|

HWY 75 |

PR 305 to PR 205 (S/B) |

Concrete Reconstruction |

|

HWY 75 |

0.5 km North of PTH 23 - PR 205 |

Concrete Reconstruction |

|

HWY 75 |

At Morris River: 0.6km North of PTH 23 |

Structure Replacement |

|

*Cost-shared with the Federal Government through the Provincial Territorial Infrastructure Component (PTIC) part of the Nation Rebuilding Program (NRP). |

||

|

HWY 83 |

0.5km North of West Junction PTH 1 to 18km North of West Junction PTH 1 |

Bituminous Reconstruction |

|

HWY 83 |

PR 355 to PTH 42 |

Bituminous Rehabilitation |

|

HWY 83 |

17.7km North of PR 482 to PTH 5 (Roblin) |

Bituminous Rehabilitation |

|

HWY 100 |

South Perimeter: Safety Plan |

Intersection Improvements, Median Closures

|

|

HWY 100 |

South Perimeter: At St. Mary’s Road |

Interchange Construction |

|

HWY 100 |

South Perimeter: At PTH 3 |

Interchange Construction |

|

HWY 100 |

South Perimeter: PTH 1W to PTH 1E |

Land Acquisition |

|

HWY 101 |

North Perimeter: Safety Plan |

Intersection Improvements, Median Closures

|

|

HWY 200 |

At Floodway: 4.4km South of PTH 100 |

Structure Rehabilitation |

|

HWY 204 |

At Red River (Selkirk): 0.4km East of PTH 9A |

Structure Rehabilitation |

|

HWY 227 |

PR 430 to PTH 6 |

Bituminous Reconstruction |

|

HWY 240 |

In Portage la Prairie: At CNR/CPR: 0.6km North of PTH 1A |

Structure Rehabilitation |

|

HWY 248 |

At Assiniboine River: 0.3km South of PTH 26 |

Structure Replacement |

|

HWY 283 |

PR 282 to PTH 10 |

Bituminous Reconstruction |

|

HWY 283 |

Saskatchewan Boundary to PR 282 |

Bituminous Reconstruction |

|

HWY 305 |

At Red River: 0.5km East of PTH 75

|

Structure Rehabilitation |

|

HWY 305 |

At Assiniboine River: 13.3km South of PTH 1

|

Structure Replacement |

|

HWY 311 |

PR 206 to PTH 12 |

Bituminous Reconstruction |

|

HWY 391 |

At Burntwood River: 3.0km North of PTH 6 (Thompson) |

Structure Rehabilitation |

|

*Cost-shared with the Federal Government through the Provincial Territorial Infrastructure Component (PTIC) part of the Nation Rebuilding Program (NRP). |

||

|

Manitoba Municipal Relations (Manitoba Water Services Board) |

||

|

Location |

Facility |

Activity |

|

Lorrette |

Water Treatment Plant |

Expansion |

|

Winkler |

Water Treatment Plant |

Upgrades and Expansion |

|

Portage Poplar Bluff Industrial Park |

Pumphouse/Reservoir |

New Pumphouse/Reservoir |

|

Beausejour |

Water Treatment Plant |

Water Treatment Plant Upgrade |

|

Stonewall |

Water Treatment Plant |

New Water Treatment Plant |

Modernizing Government and Summary Reporting

Budget 2023 invests further in ongoing work to modernize government through better performance management, transforming the public service, investing in digital government and other initiatives to improve public service delivery.

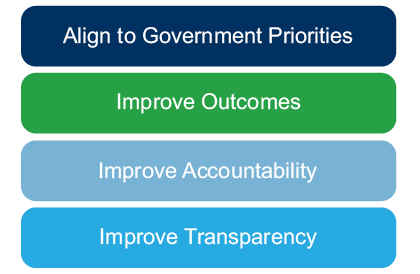

Balanced Scorecards

The Manitoba government continues to enhance and implement what is expected to be the best integrated management strategy and performance measurement framework in Canada. The framework objectives are to strengthen the alignment of department level work with government priorities, improve accountability and transparency, and to deliver better outcomes for Manitobans.

Performance measurements are helping departments focus on priority areas and on improving results that are important to Manitobans. The framework has been instrumental in supporting the whole-of-government approach by getting government departments to align their business plans with budget priorities.

Balanced scorecards improve alignment to government priorities through cascading objectives and performance measures. By measuring performance against targets, government demonstrates progress on advancing priorities and accountability for results.

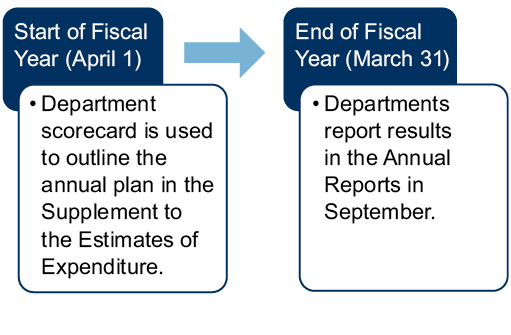

Every department’s Supplements to the Estimates of Expenditureádocument, which are departmental business plans, are tabled, distributed and available online no later than six business days after tabling the provincial budget. These business plans align with the broader government strategic priorities identified in the balanced scorecards. These plans and the annual reports are available to the public and contribute to increased transparency.

Department business plans include customized balanced scorecards, key initiatives and summary budget information, outlining their operational plans and activities for the year.

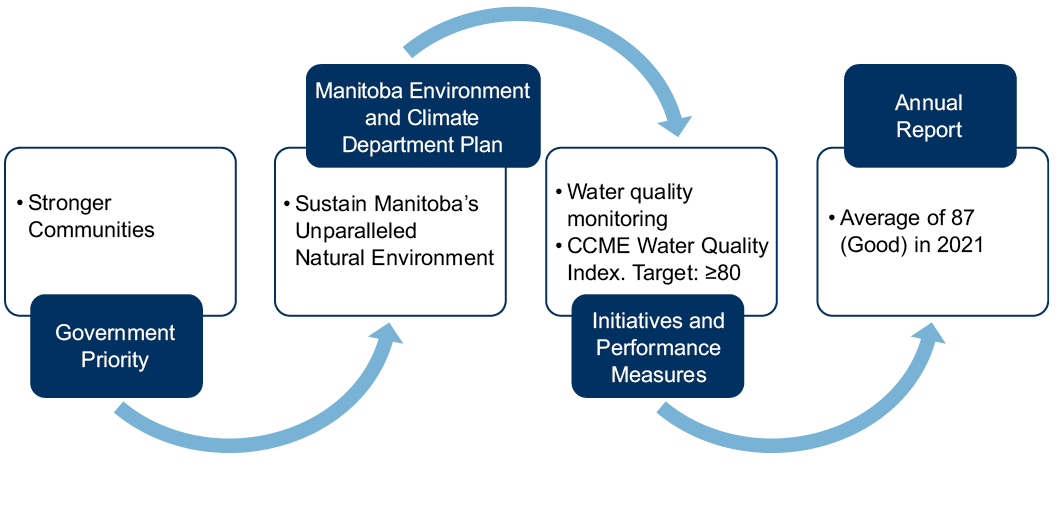

Balanced Scorecards in Action - Manitoba Environment and Climate

Manitoba Environment and Climate’s mandate is to protect and improve water quality across the province. As part of this mandate, the department monitors water quality in rivers and lakes. Water quality data are used to assess changes over time and suitability for drinking water, fish and other aquatic life, recreation, irrigation, and other important water uses. Water quality results are communicated with the Canadian Council of Ministers of the Environment (CCME) Water Quality Index.

Through balanced scorecards, Manitoba’s target for the Water Quality Index is 80 or higher, which is considered good to excellent water quality. On average across Manitoba, the Water Quality Index in 2021 was 87 (good).

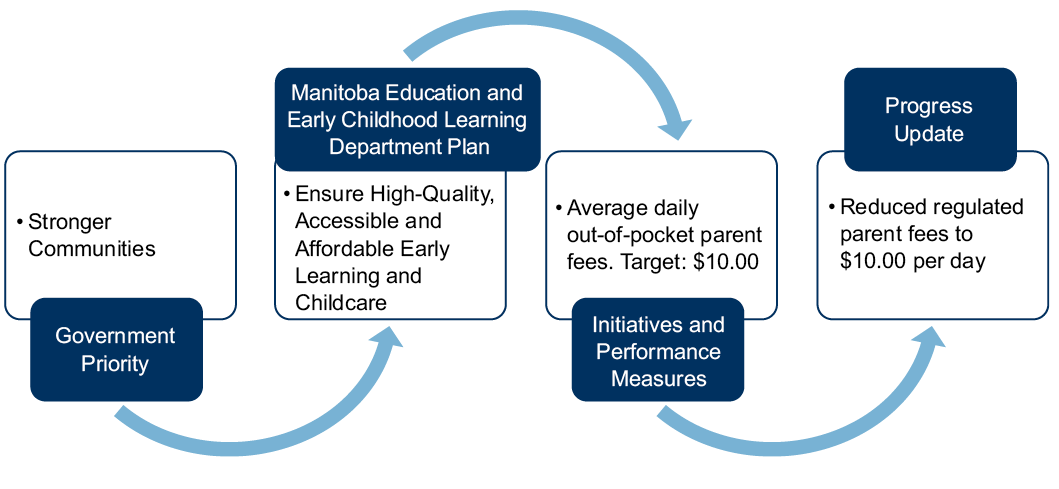

Balanced Scorecards in Action - Manitoba Education and Early Childhood Learning

Access to high-quality child care is essential for Manitoba families. High-quality child care allows parents and care givers to re-enter the workforce, upgrade their skills and training, support their families and play an active role in the vibrancy of our community and the health of Manitoba’s economy.

Manitoba Education and Early Childhood Learning’s department plan calls for ensuring access to high-quality, accessible and affordable early learning and child-care services. To achieve this, the department has committed $94-million to create more than 1,600 new child-care spaces across the province with a focus on rural and Northern communities that are on track to be operational in 2023/24.

In addition, a first-in-Canada industry recognized technical vocational curriculum cluster in early childhood education has been developed, which will help meet the pressing need for more early childhood educators. High schools will begin pilot implementation in the 2023/24 school year.

The department is also making child care more affordable for Manitobans by reducing regulated parent fees to $10 a day, and has expanded eligibility to the Child Care Subsidy Program for families most in need. This performance measure is tracked in balanced scorecards and the progress is updated.

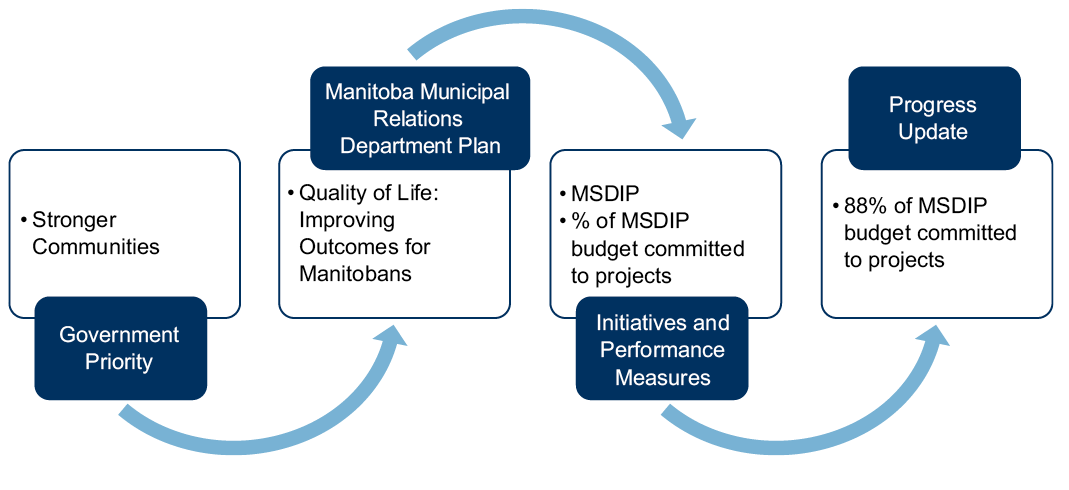

Balanced Scorecards in Action - Manitoba Municipal Relations

Manitoba Municipal Relations is tracking the percentage of the Municipal Service Delivery ImprovementáProgram’s budget that is committed to projects.áThe program launched in 2021/22 to help municipalities conductávalue-for-money audits to help municipalities maximize effectiveness when using taxpayer dollars to provide needed services to citizens.

The 2021/22 report of 88áperácent means $1.1-million of the budgeted $1.25-million was committed to projects in the program’s first year.

In 2022, a total of 22 applications were received through the second project intake. Following internal evaluation by the department, nine projects were recommended for approval by the minister. In 2023, successful project applicants will work directly with pre-qualified third-party consultants to manage comprehensive service delivery reviews for each municipality or planning district. This will result in a value-for-money audit report, including actionable recommendations. Final 2022 reports will be available for use by other local governments in 2023/24.

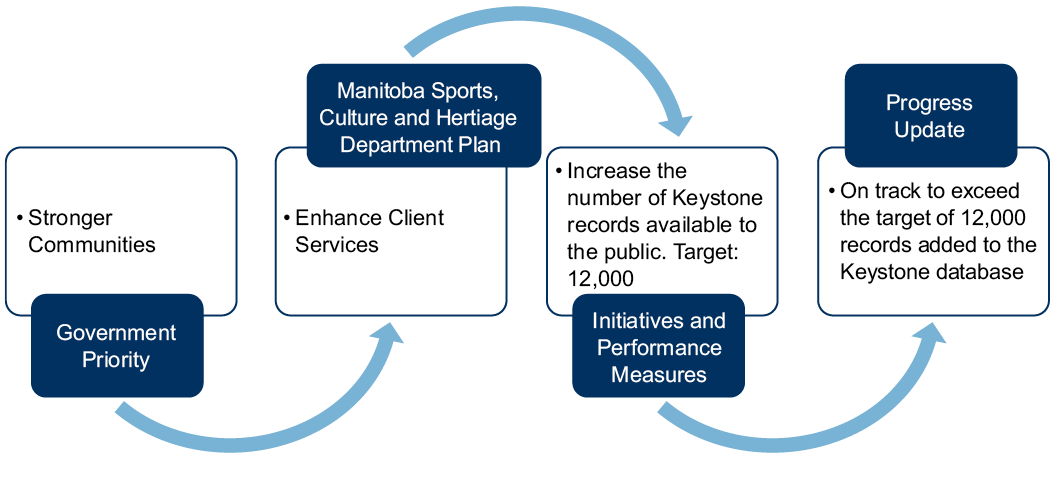

Balanced Scorecards in Action - Manitoba Sports, Culture and Heritage

Providing online access to information and services is a priority for the Manitoba government. Manitoba Sport, Culture and Heritage continues to increase online digital content, and has highlighted this goal through the following performance measures:

- increase the number of accessible departmental documents posted to InfoMB;

- increase the percentage of historical Manitoba government documents available in the Legislative Library’s Digital Collection of Manitoba Government Publications;

- increase the number of Keystone records available to the public; and

- increasing the number of archival records accessible to the public by 12,000 through the Keystone database, makes it easier for the public to search and access historical Manitoba documents.

In 2022/23, the department is projecting to exceed the target of adding 12,000 records to the database.

Procurement Modernization

The Manitoba government continues to strategically modernize its procurement practices and increase its collaboration with broader public sector entities to maximize value for money and ensure transparent, fair and competitive tenders.

By consolidating the purchasing power of core government and the broader public sector in high-value procurement categories such as facility services, information technology infrastructure and engineering services, government has achieved more than $34.5-million in savings since 2019.

With 14áperácent of government spending currently under category management and $4.1-billion in total annual addressable spending for government and the broader public sector, Manitoba has the potential to deliver hundreds of millions of dollars in annual savings in the coming years.

The Manitoba government is also working diligently on a number of initiatives aimed at simplifying the bidding process, reducing procurement time cycles and ensuring policy continues to be aligned with best practices and trade agreements.

Social Innovation Office

The Social Innovation Office brings together government, community, and private sector to solve the most pressing and complex social and environmental issues, maximizing impact. Since launching in 2019, the office has assisted government with more than 40 projects aimed at improving outcomes for Manitoba.

The Social Innovation Office has been focused on fostering innovation and cross-sector collaboration in numerous areas of government priority. Highlights of this work includes work in health care, protecting the environment and building stronger communities.

Successes have led to deeper relationships with community organizations, foundations and private sector partners. In 2023/24, work will be done to monitor the outcomes of current programs, while also collaborating to tackle more shared priorities, such as affordable housing and health care.

Healing Health Care

Government launched two outcome-based projects aimed at reducing factors associated with chronic disease while improving health outcomes. The depth of partnership on these projects has led to more collaboration, including a program that offers free menstrual products to those in greatest need and the commitment to explore more collaborative opportunities.

Protecting the Environment

The Social Innovation Office is currently using an outcome-based approach to explore an innovative way to reduce greenhouse gas emissions by diverting organic waste from landfills. The office is also exploring the opportunity of developing a sustainability bond aimed at capitalizing on the province’s ability to raise funds at low interest rates and serve as an important tool to help finance critical social and environmental projects.

Building Stronger Communities

In the fall of 2022, government announced the commitment to build nine new child-care centres using this partnership approach. Together with Manitoba Education and Early Childhood Learning, the Social Innovation Office collaborated with community partners to design a new partnership approach to the development of child-care centres. Further work is underway with community partners to co-create solutions to address the child-care workforce gap.

Supporting Manitoba Hydro by Lowering Fees

Manitoba recently took steps to financially stabilize Manitoba Hydro, including a 50áperácent reduction to both the water power rental rates and the Hydro Guarantee Fee starting in 2022/23. These changes resulted in approximately $190-million in savings for the utility that will be applied to reduce Manitoba Hydro’s debt.

These ongoing reductions will support the utility’s efforts to keep electricity rates low for Manitobans and provide the ability to start lowering its debt burden. It is anticipated that applying the savings to debt will save ratepayers $4-billion in accumulated debt over the next 20 years.

Regulatory Accountability

Creating a prosperous future for all Manitobans requires departments and government agencies to focus on regulatory modernization to ensure desired policy outcomes are achieved with the least administrative burden on stakeholders and government. Many small, common-sense regulatory changes can significantly reduce the time and resources needed to comply with provincial rules and regulations.

These small but important changes exemplify Manitoba’s commitment to identify, streamline and reduce regulatory requirements that are not achieving their intended objectives.

As a result, 100,664 regulatory requirements placed on Manitobans by government were removed by December 2022, a reduction of 10.7áperácent from the April 2016 baseline measurement of 939,827 regulatory requirements.

The Manitoba government continues to lead efforts to advance regulatory accountability and reduce red tape on inter-provincial trade. In January 2023, Manitoba removed additional exceptions under the Canadian Free Trade Agreement (CFTA) on naming and business activity restrictions for corporations providing land-surveying services, office location requirements for inter-jurisdictional law firms and residency requirements for individuals applying for wild rice harvesting and export licences. With the implementation of these latest trade barrier reductions, Manitoba will have the lowest remaining Canadian Free Trade Agreement and labour mobility exceptions in Canada.

Through the Canadian Free Trade Agreement’s Regulatory Reconciliation and Cooperation Table Work Plan, Manitoba has endorsed two reconciliation items and participated in the negotiation of 14 interprovincial Table Work Plan reconciliation items in areas including:

- occupational health and safety standards;

- technical safety;

- construction codes; and

- corporate registries.

Manitoba has also participated in the completion of two work plan cooperation items on the testing of automated and connected vehicles, and on prompt payment legislation and associated regulations under builders’ lien. These small changes help reduce barriers that impede business, investment and labour mobility between provinces.

Executive Government Organization Act Changes

Every day, hundreds of public servants from multiple departments work together to ensure the provincial government can provide the services relied on by Manitobans.

Today’s complex problems require even more collaboration amongst departments, not less. To support these efforts, changes will be made to The Executive Government Organization Act to support department efforts to share services, such as information management and technology, communications and policy development to ensure a whole-of-government response is made to address today’s challenges.

Digital Government

The Manitoba government has ambitions to accelerate Manitoba into the digital age by transforming the way citizens and business request and access public services. The plan takes a citizen and business first approach and looks at the province’s strategic priorities to establish the following themes:

- better and more efficient government services;

- improved tools and processes for cutting red tape;

- improved support for citizens and business;

- improved turnaround times on decisions and approvals;

- services where and when citizens and businesses need it; and

- 24/7 online channels for service, status monitoring and submissions.

Manitoba continues assembling the groundwork for the digital government evolution with key initiatives to drive efficiencies in the 2023/24 fiscal year. Highlights include plans to:

- establish an enterprise-wide back-office systems to modernize resource planning systems and standardize processes and information exchanges to improve how the Manitoba public service works and expand digital service delivery capacity;

- modernize the courts technology systems and align them with Manitoba Justice’s modernization goals, including electronic filing of documents, reduced paper and improved integration between systems;

- evolve citizen engagement and services technologies to streamline and enhance the citizen experience and ensure easier and faster access to services and programs, including using strategic digital platforms and an improved delivery approach to drive better fiscal outcomes;

- enhance information technology cyber security services as more digital services come online;

- advance business engagement and services technology that will streamline and enhance business experience and provide better service and program delivery, including using strategic digital platforms and efficient delivery methods; and

- support enterprise records management and undertake foundational work to support a content services platform that will streamline document workflows to improve response times.

Building on this momentum, progress continues in areas such as data science, robotics process automation and modernizing the government’s core information technology systems in the 2023/24 fiscal year. This will include:

- enhancing data science by leveraging diverse data sources and advanced predictive analytics to drive evidence-based decision-making, future focused planning and service delivery.

- implementing robotics process automation with the continued rollout of software that automates manual and repetitive activities;

- using a cloud-first approach by transitioning information technology infrastructure and business applications to the cloud, which will allow government to offer more cloud- based services that increase operational efficiencies; and

- introducing technology that supports identification and personal credential recognition within an online channel, offering an alternative to in-person visits when identification of a person is required.

Transforming Manitoba’s Public Service Culture

To provide better outcomes for Manitobans, Manitoba’s Public Service continues its transformation journey as a modern and innovative organization. In February 2022, The Public Service Act came into force and sets out the foundational principles to support a modern public service, which include diversity, inclusion, ethics and integrity.

The Public Service Commission, in collaboration with government departments, continues to advance initiatives and programs that support these principles and ensure Manitoba’s Public Service is equipped to provide high quality services and programs to Manitobans, now and in the future.

The commission is focused on supporting the development and success of public servants through leadership programs and services, consistent onboarding for new employees and new leaders and new training opportunities to advance reconciliation and to foster diverse, inclusive and accessible services for Manitobans and workplaces for employees.

Supporting a Sustainable Workforce

The Manitoba government continues to support employee development and recruitment strategies to address current and future employment needs, ensuring a sustainable workforce is maintained to meet the needs of Manitobans. This includes filling priority vacant positions to support continued direct service delivery and public safety, supporting a data-driven workforce, succession planning and targeted outreach for difficult-to-recruit positions.

Following an organizational review conducted with the assistance of a third-party consultant, the Public Service Commission is undergoing a redesign of its service delivery model. The redesign is intended to increase efficiencies in the department’s human resource, employee development, policy, data management and labour relations functions, including realigning talent acquisition into a dedicated unit focused on recruitment and outreach activities.

Employee Engagement

The Manitoba government recognizes its employees are critical to the success of the organization. A highly-engaged public service helps deliver government’s priorities and improve outcomes for Manitobans. Collecting valuable feedback from employees is a critical way to assess the needed actions to enhance employee engagement, and ensure employees have the tools necessary to maximize their potential and meet the needs of Manitobans.

The Employee Perspectives Program includes annual engagement surveys on a range of topics, including leadership, employee development, capacity and workplace culture. Past employee feedback has helped inform the development and implementation of programs such as the Learning Fund and the Idea Fund, and the most recent survey conducted in January 2023.

Starting in January 2022, Probe Research Inc. was engaged to support survey delivery and the development of an online employee panel. The panel is made up of a representative and diverse group of public servants that provide feedback through additional topical surveys and engagements throughout the year. In 2022, the panel provided meaningful feedback that will help inform the development of a new employee giving program.

To help inform actions to support employee retention, the program was expanded in the fall of 2022 with the launch of a new corporate exit survey. With this new tool, employees who are voluntarily exiting the Manitoba government or moving to another department can share their perspectives on a range of topics related to the workplace, such as employee engagement and recognition.

Diversity and Inclusion Efforts

The Manitoba government is dedicated to the ongoing advancement of diversity, equity and inclusion within Manitoba’s Public Service. Important work is being undertaken to ensure government policies, programs, and initiatives are inclusive, accessible and equitable.

In 2022, a new diversity and inclusion policy was introduced that commits to achieving an inclusive public service at all levels within the organization. A new Manitoba Government Accessibility Plan for 2023 and 2024 was also developed, and includes actions to make government workplaces, products and services accessible to all Manitobans, including employees.

The Public Service Commission continues to collaborate with employee network groups and external organizations, such as Pride Winnipeg, Indigenous-led organizations and accessibility-serving organizations, to support diversity and inclusion-related learning events and courses for public servants. In spring 2022, the Manitoba government also became an official partner of Pride at Work Canada, an organization that empowers Canadian employers to build workplaces that celebrate all employees regardless of gender expression, gender identity, and sexual orientation.

The commission is also redesigning a mandatory course for all public servants with the most current information, resources and tools that support diverse, equitable and inclusive workplaces.

Employment equity strategies within recruitment processes also continue to be assessed to support focused efforts to increase diversity within Manitoba’s Public Service, which includes giving preference to or designating competitions for members of one or more designated groups (women, Indigenous peoples, visible minorities and persons with disabilities).

Truth and Reconciliation Initiatives

The Manitoba government remains committed to advancing reconciliation in Manitoba’s Public Service by supporting the Truth and Reconciliation Commission’s Call to Action #57 and implementing The Path to Reconciliation Act through educational workshops for public servants at all levels of government. Several training and engagement opportunities were provided to public servants in the pastáyear, including:

- The Path to Reconciliation: A Historic and Contemporary Overview ;

- Building Your Indigenous Cross-Cultural Awareness ;

- Exploring the Historical and Modern Treaty Relationship ; and

- lunch-and-learn sessions with speakers from the Treaty Relations Commission of Manitoba.

In addition, workshops offered in the past year include Making Truth and Reconciliation Real, Residential School History and Experiences, and Historical and Modern Treaty Relationships.

In 2023, the Public Service Commission is launching a new mandatory course for all public servants designed to increase awareness about the historical and contemporary issues facing Indigenous peoples in Manitoba and Canada, which include Inuit, MÚtis and First Nations. The course will also build awareness of the contributions of Indigenous peoples, and ways that public servants can develop respectful and effective relationships with Indigenous peoples and communities.

The commission has also created new Indigenous consultant positions to focus on employee learning, recruitment of new Indigenous talent to Manitoba’s Public Service and other projects that advance Truth and Reconciliation acrossáthe public service.

Investing in Public Servants - Learning Fund

Since its inception in 2019, there has been considerable interest in the Learning Fund, which has become a vital initiative that supports the professional development of public servants. This $2-million centralized fund provides equitable access to all public servants to take education and training that supports job-specific and organizational needs.

Public servants’ drive for learning and development was evident in 2022. Between April and November 2022, more than 895 applications were received, of which 698 were individual and 197 were group applications. Over 95áperácent of these applications were approved at a total cost of $2-million, supporting the professional and personal development of more than 6,100 public servants.

Investing in Public Servants - Improving Employee Learning

The Public Service Commission continues to deliver workshops that support the current development needs of employees to ensure the public service is equipped to provide high quality services and programs to Manitobans, now and in the future.

Workshops for 2022/23 focused on innovation and continuous improvement that support transformation initiatives and efficiencies, as well as on interpersonal communication, mental health and wellness, stress reduction and diversity equity and inclusion training.

In 2023/24, course offerings will focus on technology, performance measurement, effective project management and further advancing accessibility through customer service and employment practices.

Investing in Public Servants - Developing Leaders

Transformational leadership training continues to be a priority for executive and senior leaders in partnership with York University’s Schulich Executive Education Centre. As of December 2022, 80 executives and 122 senior leaders have completed the programs.áFurther leadership development programming for executives, senior leaders and managers was launched in 2022/23, with additional programming planned for 2023/24.

The Leaders in Training Program, a paid internship program that helps develop future leaders, was enhanced in 2022 with the launch of a new data science internship to attract new data scientists and expertise across government. Since its inception in 2019, the program has recruited 39 interns in the general stream, 16 in the financial stream, and five in the data science stream to foster new and emerging talent in the public service.

Collective Bargaining

Summary government has approximately 200 separate bargaining units spanning departments and all government reporting entities, including school divisions, post-secondary institutions, health service delivery organizations and others.

In 2022/23, the vast majority of collective agreements were either settled or renewed by government, with the others in progress. Public servants are a valuable resource and the 2023/24 budget reflects all current contracts in both the departments and reporting entities.

Manitoba’s Economic Outlook and Review

Manitoba has one of the most diverse and balanced economies in Canada, which is made up of a variety of industries. The goods-producing sector generates 26áperácent of provincial gross domestic product (GDP) and private and public services account for a combined 74áperácent. Nearly ten industries contribute fiveáperácent or more to the total provincial GDP. Historically, a decline in one area of the economy is offset by growth elsewhere, demonstrating the provincial economy’s resiliency to downturns.

Composition of Real Gross Domestic Product by Industry 2021

Manitoba’s Economic Outlook

After a strong performance in 2022, the Manitoba economy faces several headwinds moving forward. Economies around the world are beginning to slow under the weight of decades-high inflation, tighter monetary policy, the ongoing Russian invasion of Ukraine, persistent supply chain disruptions and lingering labour shortages as markets adjust.

Budget 2023 expects the province’s real GDP to slow from 3.6áperácent growth in 2022 to 0.7áperácent in 2023, with an expansion of 1.1áperácent in 2024.

|

Manitoba Economic Outlook |

||

|

2023F |

2024F |

|

|

Gross Domestic Product |

||

|

Real |

0.7 |

1.1 |

|

Nominal |

2.2 |

3.0 |

|

Consumer Price Index |

3.8 |

2.2 |

|

Employment |

0.4 |

0.8 |

|

Unemployment Rate (%) |

5.4 |

5.9 |

|

Population |

1.0 |

1.0 |

|

per cent change unless otherwise noted Source: Manitoba Finance Survey of Economic Forecasts |

||

The Manitoba economy is not immune to these global economic forces. Private forecasters are projecting the provincial economy to decelerate in the following years, although at a slower pace relative to other provincial economies that are more sensitive to recent interest rate hikes. In fact, several forecasters are projecting some provincial economies to dip into a mild recession in 2023, but not Manitoba’s economy.

Due to strong labour market projections, the economic slowdown is not expected to translate into large-scale job losses and a spike in the unemployment rate, as is typical with a downturn. Rather, the decline in economic activity is expected to help balance labour markets by relieving pressure from existing labour shortages. Manitoba employment is expected to increase by 0.4áperácent in 2023 and 0.8áperácent in 2024.

Elevated inflation and growing incomes helped push up provincial nominal GDP growth in 2022 to levels not seen in decades, contributing to Manitoba’s strong fiscal performance in the 2022/23 fiscal year.

Restrictive monetary policy from the Bank of Canada is expected to stabilize price pressures and return inflation to target levels by 2024. Slower real economic growth, in combination with declining inflation, is projected to decelerate nominal GDP growth from 9.9áperácent in 2022 to 2.2áperácent in 2023 and 3.0áperácent in 2024. Moderate nominal GDP growth in the coming months will temper near-term tax revenue growth.

Projected Nominal GDP Growth, 2022F-2024F, Manitoba

While the Manitoba economy is expected to avoid a contraction in 2023 and 2024, future monetary policy, inflation, persistent supply chain disruptions, geopolitical tensions, and environmental events create uncertainty to the provincial outlook.

Risks to Manitoba’s Economic Outlook

There remains considerable uncertainty in Manitoba’s economic forecast, especially in 2023. The following chart illustrates the uncertainty in the economic outlook due to risk factors outlined below.

The solid line, in the chart below represents the consensus forecast (i.e., average) and the dashed lines are the highs and lows, while the shaded area represents the range of uncertain in the forecasts. In 2023, the range of forecasts is 3.2 percentage points, compared to 0.9 points in 2024.

The following factors present risks to the outlook that could potentially cause the economy to depart from Budget 2023 expectations.

Monetary Policy

Since March 2022, the Bank of Canada has increased the policy interest rate by 425 basis points to 4.50áperácent - the highest rate since 2007. The Bank of Canada has signaled its intention to stabilize inflation to target levels (between one and threeáperácent).

Larger than anticipated employment growth and persistent high inflation rates in the first half of 2023 could provide the Bank of Canada with justification to raise interest rates further. Additionally, consumer sensitivity to higher interest rates will inform future Bank of Canada monetary policy decisions.

Bank of Canada Policy Interest Rate

Inflation remains well-above the Bank of Canada’s target range. Inflation expectations that become entrenched could create challenges for businesses that are expanding and looking to create jobs. Moreover, persistent inflation in the absence of wage growth could erode household purchasing power and curtail spending. In its latest interest rate decision, the bank forecasts Consumer Price Index inflation to decline to threeáperácent in the middle of 2023 and decline further in 2024, reaching the twoáperácent target.

Supply Chain Disruptions

Global supply chain bottlenecks and shortages have been a main driver of upwards pressure on prices throughout the pandemic recovery. Although the past year saw improvements in terms of restoring global supply chains, challenges remain for several key industries. The end of China’s zero-COVID policy should relieve lingering supply-side pressures.

Geopolitical Tensions

The Russian invasion of Ukraine disrupted commodity markets and contributed to upwards pressure on prices in 2022, especially for energy and food. The Black Sea grain initiative signed in July 2022 helped to restore grain shipments from Ukraine. A sudden breakdown in the trade arrangement could exacerbate supply-side price pressures. Moreover, several Western countries introduced a price cap on Russian oil that could affect global energy prices.

Environmental Events

Climate change and extreme weather events such as droughts, flooding, and wildfires pose threats to the provincial economy and finances as these events can have a material impact on people, communities, jobs, and economic activity. For example, the severe drought experienced in 2021 resulted in below-average yields for all major crops and contributed to a substantial increase in insurance claims payable (up 213áperácent) and indemnities (up 716áperácent).

Canadian Outlook

Heading into 2023, the Canadian economy faces many of the same challenges as Manitoba.

- High inflation and interest rates are contributing to rising costs to households and businesses, underscoring affordability concerns across the country.

- The Canadian housing market continues to slide, especially in jurisdictions that experienced a surge in activity and prices during the pandemic.

- Labour markets remain tight, although ambitious immigration targets could help to alleviate labour shortages in time.

In addition, Canadian exports in 2023 are expected to be adversely affected by the projected economic slowdown in the United States (U.S.) and ongoing global supply chain issues, particularly in the manufacturing sector. `Buy American’ procurement policies noted in the most-recent U.S. State of the Union address could also create challenges for Canadian exports.

On the other hand, agricultural products, such as wheat and fertilizer, will have an advantage from strong global demand. In addition, oil and gas producing provinces will continue to benefit from elevated energy prices.

Like Manitoba, national household savings is falling from the elevated rates recorded during the pandemic to normal levels. Household spending is expected to slow as families cope with rising costs of living.

Budget 2023 expects the Canadian economy to expand by 0.5áperácent in 2023 and 1.3áperácent in 2024.

International Outlook

The outlook for the American economy has dimmed in light of the present global economic challenges. Consumer inflation is slowing in the U.S. but remains well-above target levels at 6.5áperácent growth on an annual basis in December 2022.

Elevated inflation, combined with strong employment growth and ongoing labour shortages, may provide the U.S. Federal Reserve with more justification to raise interest rates further.

The American key interest rate is currently set at 4.50 to 4.75áperácent. Further rate hikes by the U.S.áFederal Reserve will likely strengthen the American dollar relative to the Canadian dollar, which could help to stimulate demand for Manitoba exports. However, a slowing American economy is likely to offset gains made from a weaker Canadian dollar. The American economy is projected to expand by a modest 1.4áperácent in 2023 and 1.0áperácent in 2024.

China’s announcement to end the country’s zero-COVID policy should provide a boost in demand for Manitoba commodities such as copper, canola and transportation equipment, as well as restore fractured global supply chains. On the downside, renewed demand in China could accelerate present inflationary pressures. The table below shows the projected economic growth rates for Manitoba’s key international trading partners.

|

International Economic Outlook |

|||

|

% of MB exports** |

2023F* |

2024F* |

|

|

United States |

71.6 |

1.4 |

1.0 |

|

Japan |

5.7 |

1.8 |

0.9 |

|

Mexico |

3.7 |

1.7 |

1.6 |

|

China |

5.7 |

5.2 |

4.5 |

|

Euro Area |

2.0 |

0.7 |

1.6 |

|

*real GDP growth rate perácent ** per cent of exports in 2021 Source: Manitoba Finance Survey of Economic Forecasts and International Monetary Fund |

|||

Manitoba Economic Review

The Manitoba economy showed healthy growth in 2022 as the province emerged from multiple pandemic waves and a severe drought in the previous year. Overall, the Manitoba economy expanded by an estimated 3.6áperácent in 2022, ranking third highest in Canada and best among non-resource-based provinces.

Projected Real GDP Growth 2022 Provinces Canada

Notably, the Manitoba economy achieved several all-time highs, including:

- manufacturing shipments totalling nearly $25-billion, roughly $600-million above pre-pandemic levels;

- farm cash receipts increasing by $1.4-billion to $9.8-billion, 48áperácent above pre-pandemic levels;

- foreign merchandise exports surpassing $20-billion, nearly $5-billion above pre-pandemic levels;

- investment in residential construction eclipsing $5-billion;

- the labour force population reaching a record 709,800;

- employee compensation exceeding $40-billion for the first-time ever; and

- the second lowest unemployment rate in Canada at 4.6áperácent.

See the appendix on page 100 for a comprehensive listing of Manitoba economic statistics.

Inflation

Consumer inflation, as measured by Statistics Canada’s Consumer Price Index (CPI), reached a near 40-year high in June 2022 in Manitoba, peaking at 9.4áperácent growth year-over-year. Since then, inflationary pressures have eased slightly, falling to 8.0áperácent growth in December. Annual consumer inflation in 2022 was 7.8áperácent in Manitoba and 6.8áperácent in Canada.

Some indicators in the inflation data are pointing in the right direction. Energy prices have declined from their peak of 40.7áperácent year-over-year growth in June 2022 to 15.2áperácent growth in December. However, elevated inflation has spread beyond energy into other commodities, particularly food and services, which are seeing accelerated price growth in recent months.

Consumer Price Inflation

Budget 2023 expects consumer inflation to fall to 3.8áperácent in 2023 and 2.2áperácent in 2024. However, as noted in the outlook risks section above, inflation expectations that become entrenched could see high inflation persist for longer.

Labour Market

The Manitoba labour market experienced a robust recovery in 2022 underpinned by strong economic growth and record immigration. After losing 90,500 jobs during the pandemic low in April 2020, Manitoba has regained more than 100,000 jobs.

Moreover, the Manitoba labour force was the fastest to return to pre-pandemic levels further underscoring the economy’s resiliency. In 2022, Manitoba employment expanded by 2.7áperácent, representing the second largest growth in recorded history - trailing only last year. Additionally, the provincial labour force reached a new record high of nearly 710,000 persons. A growing labour force is integral to meeting the demands of future business investment and an expanding economy.

The strength in job growth contributed to one of the lowest unemployment rates in Canada at 4.6áperácent. Manitoba’s strong labour market also plays a role in insulating the provincial economy from the recession projected in other provincial economies in 2023.

Annual Unemployment Rate, 2022, Provinces Canada

With a surging economy and robust demand for labour, businesses in several key industries have reported labour shortages. Indeed, the number of job vacancies in Manitoba reached a record high in the third quarter of 2022 at 32,290, representing a 102áperácent increase above the same quarter in 2019.

Jurisdictions from across Canada and the United States are experiencing similar challenges. In Canada, the number of job vacancies surpassed one million in the second quarter of 2022.

Higher wages help households to retain purchasing power and sustain against the rising costs of goods and services. However, persistent upwards pressure on wages is a challenge for businesses expanding and looking to create jobs.

A tight labour market and rising costs of living is giving workers more leverage in negotiating higher wages. Unsurprisingly, wages in Manitoba are showing signs of acceleration. Consumer inflation increased on average by 0.6áperácent in 2022, whereas wages only grew by 0.4áperácent.

Average monthly wage growth and consumer inflation Manitoba

Over the past five months, however, monthly wage growth outpaced inflation, increasing on average by 0.5 per cent. Budget 2023 expects employment growth to slow from 2.7áperácent in 2022 to a modest 0.4áperácent in 2023 and 0.8áperácent in 2024.

Rolling Annual Farm Cash Receipts Manitoba

Agriculture

The 2022 crop production season got off to a slow start, mainly due to exceedingly wet conditions in the spring. Despite the late start, the growing season turned out to be favourable with adequate moisture and suitable above-average temperatures. This allowed crops to flourish and mature before any frost damage. While the two largest crops, canola and wheat, achieved yields slightly below recent averages, the soybean, oat and corn yields set new records.

Despite the delays and unseeded acres, 2022 production was overall above average and a welcome recovery following the 2021 drought. In fact, Manitoba’s farm cash receipts increased by $1.4-billion to $9.8-billion, 48áperácent above pre-pandemic levels.

With low inventories after 2021 and a delayed 2022 harvest, the volume of crops available to market was notably lower during 2022. Fortunately, prices remained at elevated levels and farm cash receipts from crops registered slightly higher than 2021 levels and set new records. However, higher prices for key inputs, including fertilizer and fuel, largely curtailed gains in profit margins.

Looking ahead for 2023, global demand for crops continues to show steady strength and prices are expected to remain at around current levels until the size of the 2023 harvest becomes more confidently known. With the large 2022 harvest, supplies available for sale will allow steady marketing until the 2023 harvest.

Livestock receipts enjoyed strong growth in 2022, driven by the hog sector. Similar to crops, this was driven by higher production and higher output prices, while higher input costs - notably feed - offset some of the revenue gains. Heading into 2023, the hog, dairy and poultry sectors are expected to see slower but steady growth, while the cattle sector continues to recover after the 2021 drought contracted herd numbers.

Population

Manitoba has the fifth largest population in Canada at 1,420,228 persons (Oct. 1, 2022), representing roughly 3.6áperácent of the national population.

Manitoba’s population is relatively young, with a median age of 37.7 years on Jul. 1, 2022 - the lowest median age among provinces, and below Canada’s median age of 40 years. Manitoba’s younger population will create an ongoing supply of labour for the province in the coming years helping to minimize emerging shortages.

Since the inception of Manitoba’s Provincial Nominee Program (MPNP) in 1998, immigration has contributed an increasing number of new residents to the province. However, on Mar. 18, 2020, the Government of Canada implemented travel restrictions aimed at reducing the spread of COVID-19. In addition, the implementation of COVID-19 related health and safety measures within Government of Canada offices affected processing times for immigration applications and temporary resident permits.

As a result of these measures, both population growth and immigration levels slowed during the height of the pandemic. Between Oct. 1, 2019 and Oct. 1, 2020, Manitoba’s population increased by 7,727 persons - well below the pre-pandemic ten-year average of 16,197 persons per year. During the 2019/20 period, Manitoba gained 10,888 immigrants - a 29.2áperácent decrease compared to the average for the 2009/10 to 2018/19 period.